Contact Seller

Auction: 240 +/- Acres Rush County, Ks

Description

For: Nancy and Michael Robinson

Date: Friday, October 27, 2017

Time: 10:00 A.M.

Auction Location: LaCrosse Livestock Market Inc.2340 Highway 183, LaCrosse, KS 67548

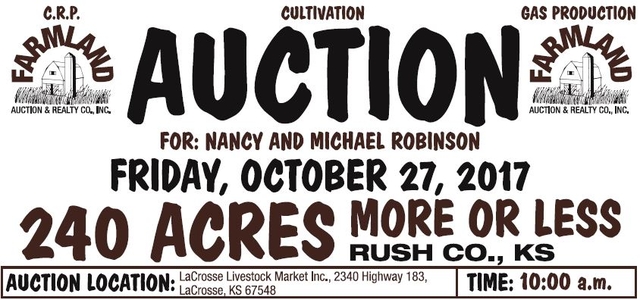

Land Location

From Otis, Ks, go 3 miles West on Hwy 4 to CR360 then ¾ of a mile North to the SEC of Tract 1

From Otis, Ks, go 4 ½ Miles West on Hwy 4 to the NEC of Tract 2

From the intersection of Hwy 183 & Hwy 4 in LaCrosse, Ks go 11 miles East on Hwy 4 to CR360, then ¾ of a mile North to the SEC of Tract 1

From the intersection of Hwy 183 & Hwy 4 in LaCrosse, KS go 9 miles East on Hwy 4 to the NWC of Tract 2

Tract I Legal Description

Southeast Quarter (SE/4) of Section Twenty (20) Township Seventeen (17) South, Range Sixteen (16) West of the 6th P.M. Rush County, Ks

F.S.A Information

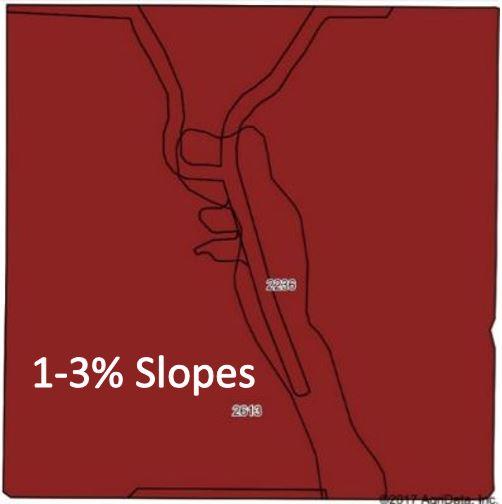

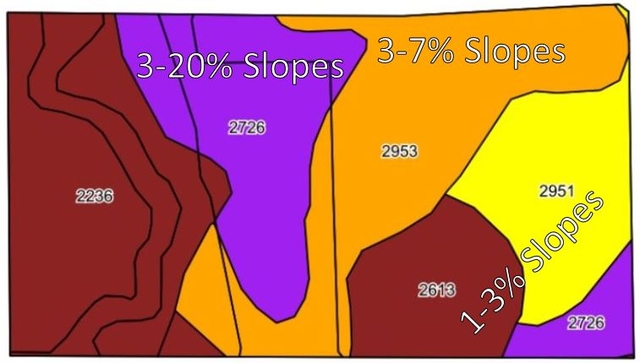

146.01 Acres Cultivation (100 Acres planted to wheat)

9.11 Acres Grass Waterways

1.07 Acres Old Farmstead

Tract II Legal Description

North Half of the Northwest Quarter (N/2 of NW/4) of Section Thirty-One (31) Township Seventeen (17) South, Range Sixteen (16) West of the 6th P.M. Rush County, Ks

F.S.A Information

40.6 Acres C.R.P. @ $40.45/acre contracted 10-01-13 through 09-30-23 with Purchaser receiving 66.67% of the 2018 and future C.R.P. Payments

8.73 Acres Cultivation (planted to wheat)

11.41 Acres Native Grass

3.98 Acres Creek & Trees

0.34 Acres Gas Well site

General Info

Tract II contains a producing gas well. The annual production for 2012-1,477 MCF, 2013-1,304 MCF, 2014-644 MCF, 2015-1,177 MCF, 2016-1,606 MCF. Decimal interest being .00625. Effective date of transfer of oil & gas production January 1st, 2018.

Taxes

Seller to pay 2017 and prior taxes. Purchaser to pay 2018 and future taxes. 2016 taxes for Tract I were $1,359.34 and for Tract II they were $199.48

Possession

After the 2018 wheat harvest with 1/3 of the harvested wheat to be delivered to the nearest elevator in the purchaser’s name. Purchaser to be responsible for 1/3 of the fertilizer and fungicide costs. Upon closing on native grass, C.R.P, Creek, and idle cultivation with purchaser paying tenant for the burn down cost.

Tenants reserve the rights of ingress and egress for removal of bales, located on Tract II, until January 1st, 2018

Government Programs

Purchaser to stay in compliance with all US Government Programs the property is presently enrolled in. Government payments to follow the current FSA payment guidelines.

base acres yield program

Tract 1 Wheat-59.38 34bu PLC

Oat- 2.46 40bu PLC

G.S.- 57.59 59bu PLC

Tract 2 Wheat-3.47 34bu PLC

Oat-0.14 40bu PLC

G.S.-3.36 59bu PLC

Minerals

All sellers interest to be conveyed to purchaser. To seller’s knowledge all minerals are intact.

Terms

10% down day of sale, balance to be paid upon title approval and delivery of deed, said closing to be on or before November 27, 2017 or as soon as title requirements, if any, can be corrected. Seller(s) to furnish warranty deed and title insurance showing merchantable title in Seller.

Agency Disclosure

Farmland Auction & Realty Co., Inc. is the agent of the seller. If the purchaser desires representation, legal counsel is advised. Announcements made day of sale shall take precedence over printed material

Farmland Auction & Realty Co., Inc.

1390 E 8th, Unit A, Hays, KS 67601

785-628-2851 Toll Free: 1-888-671-2851

E-Mail: farmland@farmlandauction.com

Web: www.farmlandauction.com